Key Take-Aways from the June Statistics

The Fraser Valley Real Estate Board’s home sales data has been released for the month of June, and the slow down anecdotally cited by many during the past month’s conversations has shown up in the data. Sales are down, prices are flat and the quantity of listings is up. Incidentally, the direction of many of the month-over-month changes in key metrics are arguably typical for June as May tends to be the market’s annual peak; however, it appears the softening has been exacerbated by the unexpectedly tame Spring market.

Highlights from the June statistics include:

- Benchmark Prices that held relatively flat, save for condos which saw a 0.7% decrease

- Single Family Benchmark Prices in South Surrey which outperformed by a significant margin with a 0.9% increase. Similarly, townhomes in North Delta increased 1.6%.

- A 7-15% dip in the quantity of sales compared to last month.

- Approximately 8% fewer new listings in June, compared to a historical average decrease of 4%.

- A significant reduction in the average days on market for detached homes, from 27 to 24 days, when townhomes held flat, and condos increased from 24 to 30 days.

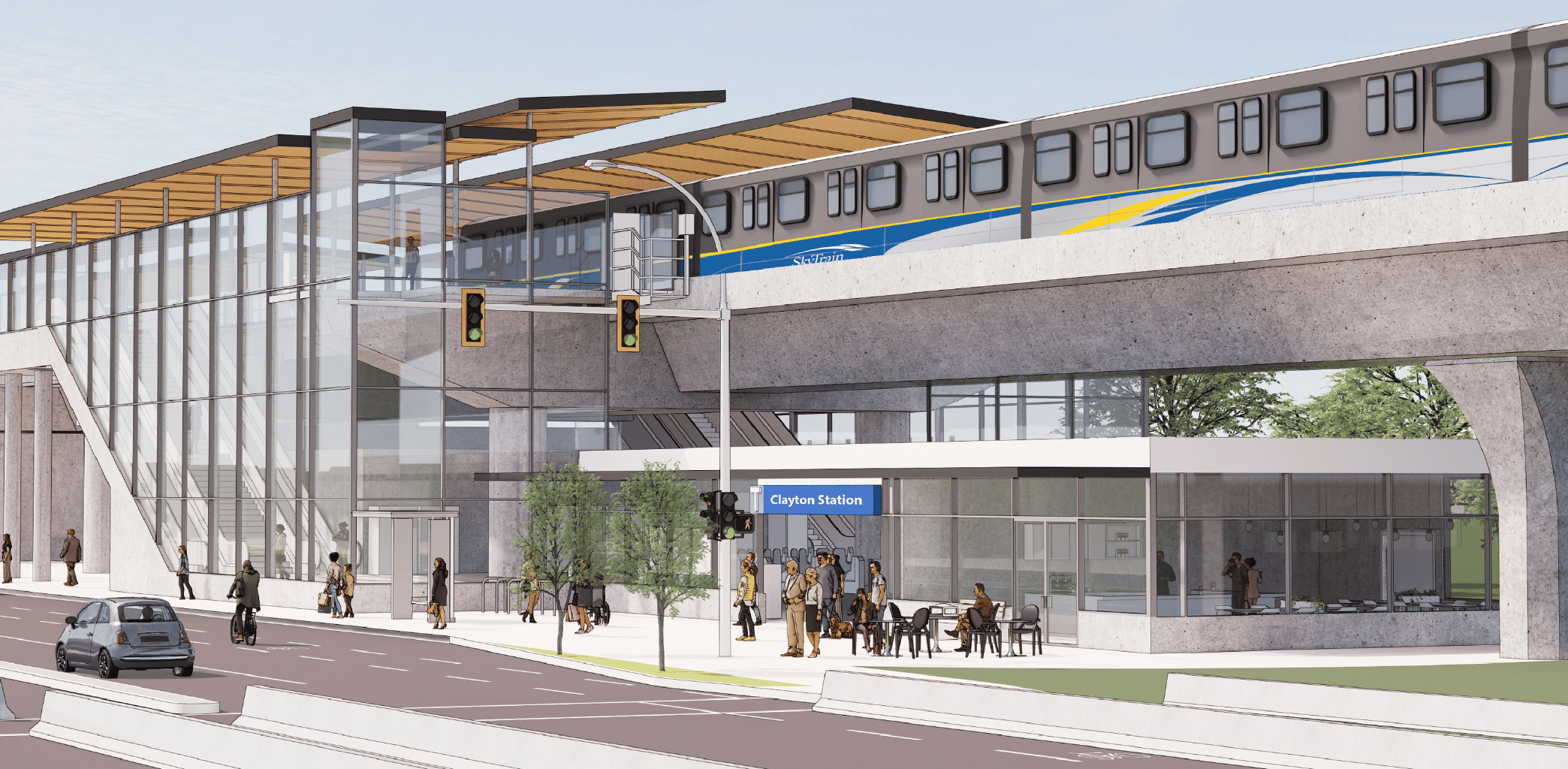

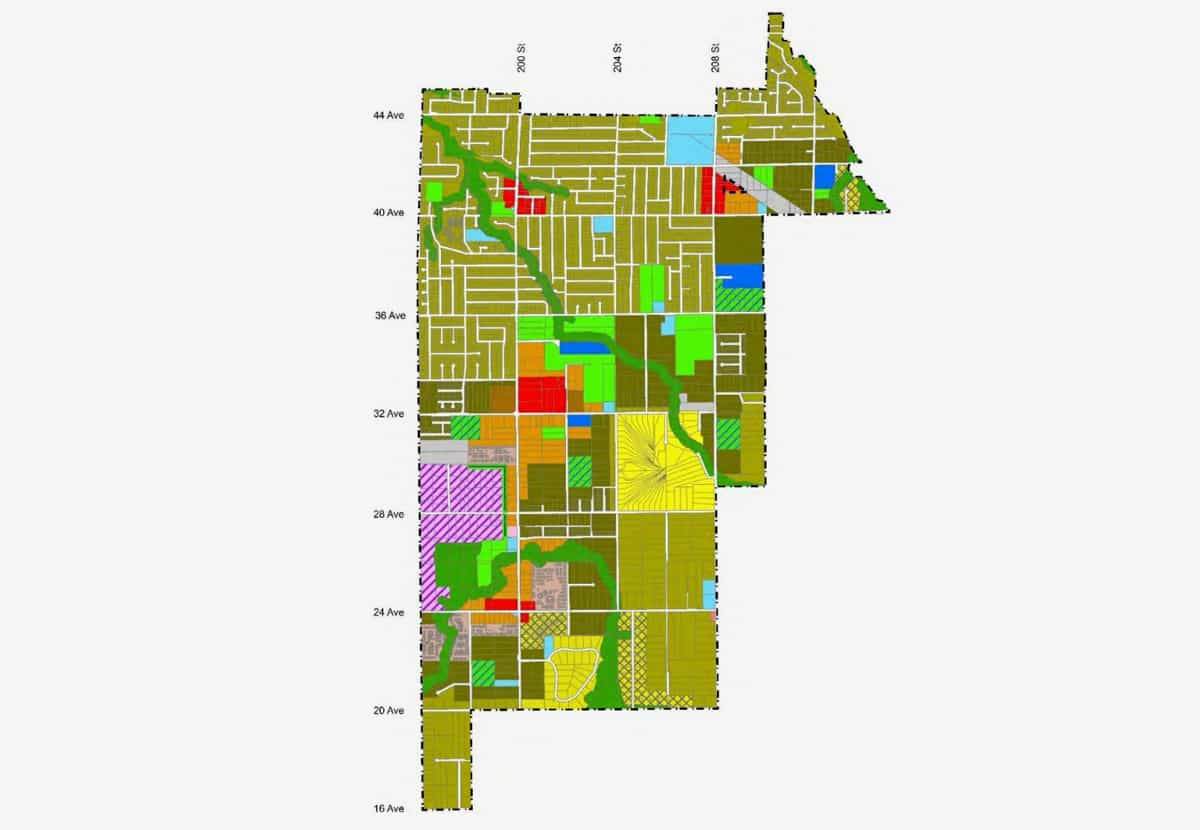

How the Fraser Valley land market is reacting

On the whole, the residential land market in the Fraser Valley is persistently active and positive despite a home sales market that has slowed considerably over the past 30-60 days. That slowdown, however, has been counterbalanced by steady end product prices, admittedly “fine” tempo absorption levels and pockets of massive success at a few recent project launches.

In reflecting over the past month of conversations with developers and investors, a pair of themes stand out:

The first is that the divide has grown considerably between those with access to capital and those being absolutely hammered by the high interest rate environment or worse yet, in foreclosure. Similarly, the sheer quantity of groups at the extreme ends of that spectrum is remarkable and there aren’t many groups in the middle. The result is both multiple offer situations and a surge in court-ordered sales.

The second dominant theme, is that acquisition opportunities need to be genuinely unique (not just unique because us brokers can’t help but put that in our marketing), priced-well or have unusually good terms to gain traction from those potential purchasers with capital. Development sites with significant challenges, outsized uncertainty or even slightly optimistic price expectations are hearing crickets while others receive multiple offers in a matter of days. It’s almost binary.

At the end of the day though, offer and deal activity remained steady for us in June, largely a function of identifying matches between the well-capitalized groups and those unique opportunities held by true sellers.

A snapshot of key metrics

June 2024

Detached homes

The single family detached home market is consistently the first segment to move, either up or down, when the market is shifting. As a result, we look to this segment as an indicator for market directionality and velocity.Home sales in the Fraser Valley

The following charts summarize the month’s total home sales throughout the Fraser Valley.Days on Market

Days on Market is the average length of time listings of that home type stayed on market before selling firm. This metric is an indicator of competition among buyers and the month-over-month change can tell us whether the market is accelerating or decelerating.New and active listings in the Fraser Valley

New listings is the cumulative quantity of listings posted for the month. Active listings is the quantity of active listings on the last day of the month.Listings over time

Listing metrics tend to be seasonally cyclical making month-over-month reports misleading as indicators of market shifts. The below chart shows each month's active and new listings over the past decade. The current month is highlighted on each line to illustrate how today's data compares to the past 10 years of data for the same month.

HPI benchmark prices

HPI Index establishes "Benchmark Prices" for a typical home in each major housing category. Benchmark Prices, as a relative metric, tend to be a more accurate indicator of market direction and velocity as they are not subject to the composition of home types being sold, like average home prices.For more information on the residential development land market in the Fraser Valley or to sign up for my monthly newsletter, please contact:

.png/9214f10c-2d6f-893a-588c-a32504fc371b?t=1181842726)

Read other Fraser Valley development land news

Data sourced from Fraser Valley Real Estate Board